As a public company, being accountable to shareholders and employees and maintaining sound and stable financial performance allow the Company to have the resources to invest in research and development and continue to provide advanced services to customers as well as promote technology and innovative applications developments. Therefore, the pursuit of sales growth is one of the cornerstones for the Company's sustainable operation.

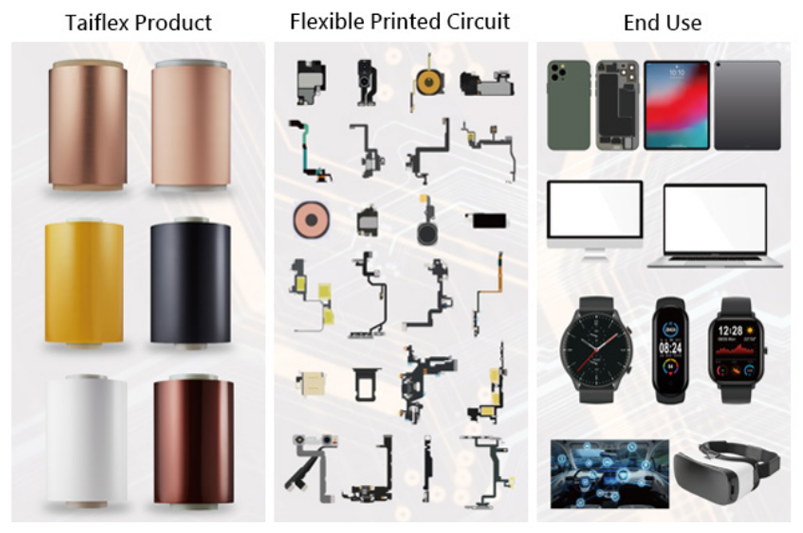

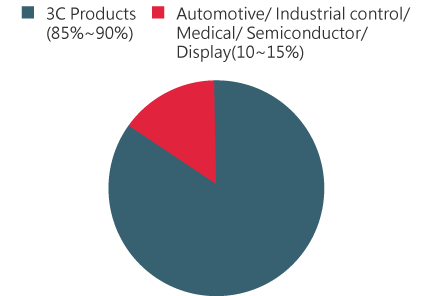

As a world's leading supplier of FPC materials, our product portfolio includes Flexible Copper Clad Laminate (FCCL,) cover-layer, bonding sheet, stiffener and composite materials. Once processed by our Flexible PCB (FPC) customer, these materials can be applied to computer, communication and consumer electronics (3C products,) mobile devices, wearable devices, automotive multimedia and others fields.

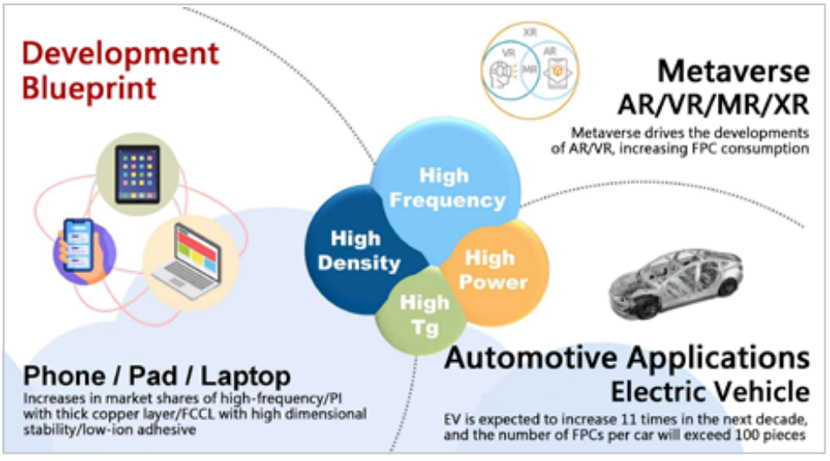

With advantages of being flexible, light and thin, FPC materials are widely used in consumer products that are size-sensitive. Thus, adhesiveless FPC material (2L-FCCL), having the advantage of being thinner, officially replaces adhesive FPC material (3L-FCCL) to become the main specification in the market. Furthermore, the increasing demand for high data transmission leads to a proactive shift towards high-density, fine-line, low-loss and high-speed applications.

In addition, the trend of lightweight electric vehicles (EVs) drives the transition from traditional copper cable harnesses to FPCs for the battery management system (BMS) within the electronic control system. We therefore expect an increasing demand for automotive-grade FCCLs that are high-temperature and high-pressure resistant. We have already built a factory in Thailand to expand our capacity for automotive materials. Please refer to “Column - Our Presence in Thailand” of this report for detailed information.

The global supply of FCCL is dominated by Japan, Taiwan and Korea. However, the PCB industry in China has grown rapidly in recent years with help from the government. A complete industry cluster, including upstream copper foil plants and CCL plants and downstream assembly factories, is taking shape. Meanwhile, there are also peers of the Copper Clad Laminate (CCL) sector tapping into the FCCL market, complicating the industry competition.

Faced with a dynamic industry environment, we will persistently build long-term competitive and sustainable operation, continue to invest research and development resources in advanced materials for flexible electronics and semiconductor materials, and strengthen our core competence, working towards producing high-value added products. At the same time, we will leverage our leading position in flexible materials to collaborate with customers in order to capture the driving forces of market growth and lay a solid foundation for sustainability. In 2022, our global market share in FPC reached 11.4%.

Under the dual impact of price spikes and central bank raising interest rates, the end-market demand of the global consumer electronics plummeted. The plunge along with the digestion of substantial inventories accumulated during the pandemic in every segment of the supply chain put sales under greater recessionary pressure. Our operating revenue amounted to NT$8,151 million in 2023, down 6.6% from the previous year, with an earnings per share of NT$2.02. Please refer to Appendix I ESG Information - Economic Data of this report for detailed financial data.

Moving forward, the Company will continue to actively implement various operational and risk control measures, such as increasing local purchases, adopting flexible inventory strategies for key raw materials and products, optimizing product structure, and persistently executing cost improvement, production efficiency enhancement as well as expense control. We aim to mitigate the negative impact of declining demand and enhance our resilience. Besides reducing the adverse effects of uncertainties, we will escalate our investments in new material research and development as well as product sampling, striving to expand our market share while awaiting economy recovery to seize the growth opportunity from next material upgrades.

| Item/Year | 2021 | 2022 | 2023 |

|---|---|---|---|

| Net revenue (In thousands of NT$) | 9,405,002 | 8,721,875 | 8,150,519 |

| Operating Costs (In thousands of NT$) | 6,607,973 | 5,059,307 | 4,395,498 |

| Gross profit (In thousands of NT$) | 2,198,643 | 2,078,863 | 1,791,507 |

| Operating income (In thousands of NT$) | 948,808 | 648,080 | 487,598 |

| Non-operating income and expenses (In thousands of NT$) | -7,994 | 229,233 | -5,279 |

| Income before income tax (In thousands of NT$) | 940,814 | 877,313 | 482,319 |

| Net income (In thousands of NT$) | 744,862 | 691,713 | 360,723 |

| Total comprehensive income (In thousands of NT$) | 758,884 | 662,244 | 528,248 |

| Earnings per share (NT$) | 3.51 | 3.35 | 2.02 |

| Employee benefits (In thousands of NT$) | 31,507 | 28,197 | 27,764 |

| Dividends (In thousands of NT$) | 522,799 | 522,799 | 313,680 |

| Employee wages (including employee benefits) (In thousands of NT$) | 1,176,330 | 1,316,059 | 1,196,958 |

| Retained economic value (In thousands of NT$) | 880,037 | 1,602,168 | 2,089,352 |

| Payments to providers of capital (In thousands of NT$) | 543,597 | 558,005 | 346,136 |

| Payments to government (In thousands of NT$) | 196,002 | 185,636 | 171,596 |

| Community investment (In thousands of NT$) | 1,063 | 700 | 928 |

For long-term consideration of organizational sustainability, expanding our global presence and establishing overseas footprint have always been a crucial part of our planning. Upon prudent evaluation, we had selected Thailand as the Group's third production base and chose to build the factory at Amata City Chonburi after several on-site inspections.

With 30 years of experience in industrial park development and having these industrial parks contributing to more than 10% of Thailand's GDP, Amata Group is a leading developer of industrial and commercial zones in Thailand. The Amata City Chonburi, located in Chonburi Province, southeast of Bangkok, is part of Thailand's Eastern Economic Corridor (EEC). Covering an area of 4,000 hectares, it is the largest industrial park in Thailand. With over 770 companies and a total workforce exceeding 210,000 people, it has evolved into a sizable industrial cluster, fully equipped with functions of living, leisure, education, and research. The park is connected by two highways, allowing access to Suvarnabhumi International Airport (BKK) and Laem Chabang, Thailand's largest port, within half an hour, and it is only a one-hour drive from downtown Bangkok. In addition, a planned high-speed rail line is expected to set up a station here. All of which highlight its convenience in terms of transportation. Furthermore, the “Amata Taipei Smart City,” a joint venture between Taiwan and Thailand, is adjacent to the north of the industrial park with construction commenced in January 2022. A future industrial cluster of Taiwanese companies where technological expertise and operational capabilities can be better aggregated could create enormous business opportunities.

Thailand's advantageous geographical location as a vital transportation hub in Southeast Asia, coupled with its government's active promotion of free trade and investment incentives, prompt flourishing developments in economy and industries which is favorable for our continuous growth. More importantly, Thailand is a major automotive manufacturing center in Southeast Asia, often referred to as the “Detroit of the East.” With a complete automotive supply chain, it stands as the largest automotive manufacturing and exporting country in Southeast Asia and has been actively driving the EV industry development in recent years. With proven experience in mass production of EV materials and being the only FPC material supplier with a factory in Thailand, Taiflex will become an integral part of the automotive component supply chain in Thailand, realizing local production to provide more timely services to meet the needs of automotive customers.

The area of our Thai factory was nearly 42,000 square meters. We invested US$35 million for phase one of the project to manufacture double-sided adhesiveless FCCL. With a focus on the enormous potential of the automotive market in Southeast Asia, we plan to manufacture other FPC materials including cover-layer and adhesive FCCL.

We actively promote the concept of low-carbon economy, and our new factory in Thailand is a green factory in line with the RE100 initiative. In addition to installing rooftop solar power systems on the premises, we signed a tenyear purchase agreement with the Enmax Group (Thailand) for green power certificates of 75 GWh on February 6, 2024 to meet the expectations of customers and the international community, and provide a solution for our Thailand factory to achieve RE100.

Our new factory in Thailand is scheduled to commence mass production in the second quarter of 2024, with an opening ceremony in May. Upon full completion, it will be the green manufacturing benchmark within the Group and lay a solid foundation for the Group's operations in Southeast Asia.