Operations of a company shall be conducted with business ethics; therefore, they are in compliance with relevant laws and regulations, which are also the commitment and responsibility of Taiflex to its shareholders and other stakeholders.

“Integrity, Responsibility, Enthusiasm, Creativity and Execution” are the core values of our corporate culture and we have, with reference to the Code of Conduct - RBA, established the “Code of Ethical Conduct,” “Principles of Business Ethics” and “Procedures and Guidelines of Business Ethics.” All employees of the Company and its subsidiaries have signed the CIPP to ensure the implementation of our core values.

We conduct our business activities based on the principles of fairness, transparency, honesty, and integrity. Directors, managers and employees of the Company are prohibited from offering, accepting, promising or demanding, either directly or indirectly, any improper benefits, or engaging in any other major unlawful behaviors or serious breach of integrity or fiduciary duty, including infringement of intellectual property rights, unfair competition and other illegal acts, in order to obtain or maintain benefits during the course of business.

In order to cultivate an organizational culture of mutual support, friendliness, discipline, honesty, and hard work, the Company regularly advocates the concept of “integrity and ethical conduct” to all employees, instilling integrity and ethical standards in the minds of our employees.

In 2023, the coverage rate of integrity advocacy to employees and relevant education and training undertaken by Directors were both 100%. For suppliers, we have set up an e-trading platform to implement integrity management and audits.

| Category | Number of People | Number of Trainees | Coverage Rate |

|---|---|---|---|

| Employees | 785 | 785 | 100% |

| Managers | 18 | 18 | 100% |

| Total | 803 | 803 | 100% |

Advocacy coverage rate = Number of people cover by the advocacy / Total number of people in the category × 100%

The Company has established an effective accounting system and internal control system for business activities with a higher risk of unethical behavior. We also set up an explicit and effective reward and punishment system by integrating business ethics policy with employee performance evaluation as well as personnel policies for effective management.

To prevent misconduct, an internal complaint channel has been set up to receive complaints concerning the violations of integrity and ethics. Where a major violation is identified upon investigation or where the Company may suffer significant losses, a report would be prepared immediately to notify the Independent Directors in writing. Disciplinary actions to be taken along with the complaint system would be announced. The violator's job title and name, date and details of the violation and actions taken would be immediately disclosed on the Company's intranet.

There were no reported violations of ethical and integrity management practices in 2023, nor any violations of laws and regulations concerning antitrust, market monopoly, integrity and business ethics.

The purpose of the internal control system is to ensure the effectiveness of procedures and standard measures for the nine major cycles of sales, production, procurement, financing, payroll, property, plant and equipment, computer information, investment, and research and development, on the basis of applicable laws and regulations of the industry we operate in and our overall operating activities. The system is reviewed and adjusted on an ongoing basis for changes in internal and external environments and regulations, thereby enhancing the effectiveness of management and product quality.

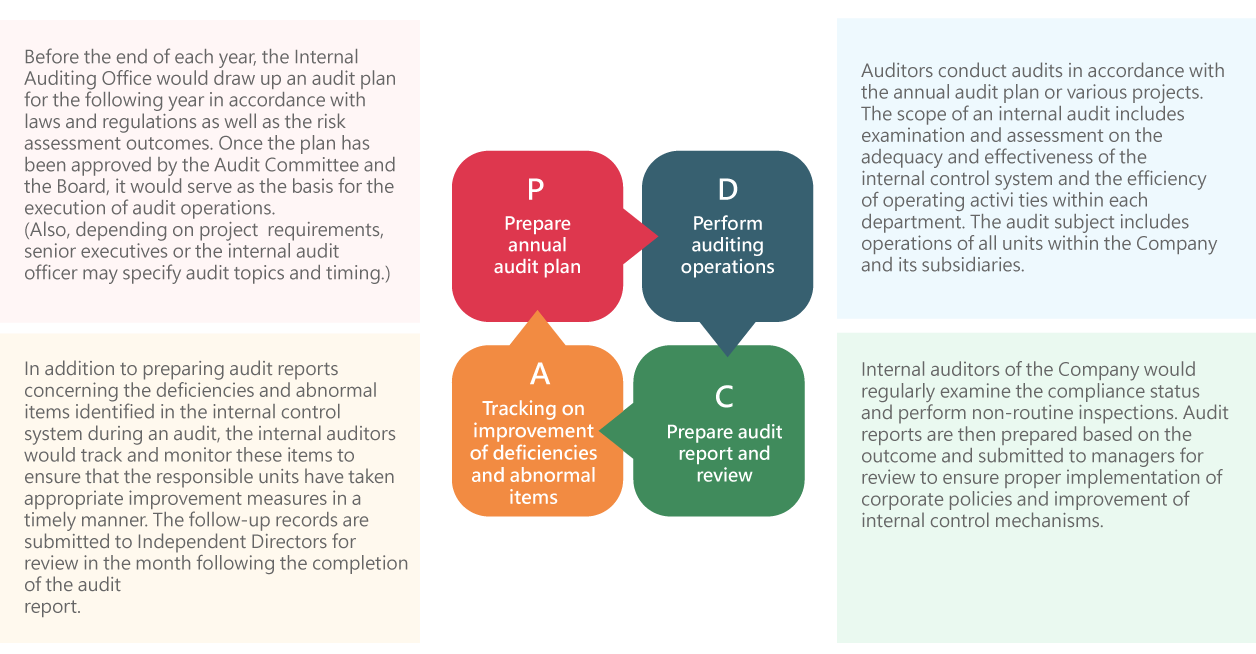

The Company has set up an Internal Auditing Office under the Board, and employed full-time auditors to perform internal audits on the overall operations. The independence of the Office enables it to achieve the purpose of auditing the Company's business conducts. Through supervision and inspection on operations and management procedures, deviations from the corporate policies, operating procedures, established goals or expected standards can be identified in a timely manner and reported to the appropriate management level. Corrective actions are taken to prevent abuses so as to stabilize the business operation.

In order to strengthen the functions of the Company's auditors, they are required to attend audit-related courses organized by professional training institutions to enhance their professional competence every year. Through professional and independent internal audit structure, the internal control system can be applied to all levels of the Company. In 2023, there were 50 audit items with no major deficiency identified in internal control. The Statement of Internal Control System is available in the annual report.

As regulatory compliance is fundamental to business operations, with business across Asia and aggressive global expansion, we have established policies and procedures for regulatory compliance within our business scope, including but not limited to prevention of corruption, antiharassment/discrimination, environmental protection, and protection of confidential information. We also set up the Legal and Intellectual Property Center to review domestic and foreign laws and regulations regularly and when needed as well as take external courses to understand regulatory amendments and the latest developments. The Center also analyzes policies and laws that may have a significant impact on the business operations, and passes on the information to relevant departments and management in order to formulate response strategies and serve as a reference for future business directions.

In order for employees to understand the essence of regulatory compliance and to ensure compliance during business execution, we invite legal professionals and industry experts to hold seminars and courses at the Company. In addition, the Legal and Intellectual Property Center promotes the concept of compliance through announcements and emails regularly and when needed.

In 2023, there were no significant penalties exceeding NT$1 million. However, the Company was subject to a fine of NT$50,000 for violating Paragraph 2, Article 32 of the Labor Standards Act due to overtime hours in excess of the regulatory limit. We will increase headcount for proper allocation of workload, monitor employees’ overtime hours, and enhance advocacy of overtime regulations to prevent violations of the laws due to extended working hours.

The Company does not make any political contribution and pays taxes every year in accordance with domestic and foreign tax laws and regulations. Since we meet the criteria set by the government for the promotion of investments in smart machinery as well as research and development, we are entitled to some tax credits. Please refer to Appendix I ESG Information - Economic Data of this report for detailed information.

The tax affairs of Taiflex are managed by the Finance and Accounting Center, which oversees tax compliance at our domestic and overseas operation bases and stays updated on global tax law developments. It reports high-risk tax incidents to the Board of Directors for the management to understand the internal risks and tax trends. Through effective risk management mechanisms, it contains the frequency and amount of tax disputes to a lower risk level. The following tax policies are established to reduce tax risks and pursue the optimal interests of the Company and its shareholders: