Sound corporate governance is the cornerstone of sustainable operations. Therefore, enhancing information transparency not only safeguards the rights of shareholders and stakeholders to be fully informed, participate and determine major corporate matters, but also is one of the necessary means to strengthen alignment between both parties towards the Company's development goals and propel the Company towards sustainable operations.

The Board of Directors is the highest governance body of Taiflex, consisting of nine Directors with extensive industry experience. The Board is chaired by the Chairperson who is not a member of the management team. Lead by the Chairperson's governance philosophy, the Board upholds the core values of “devotion, integrity, diversity and independence” and is responsible for overseeing the Company's regulatory compliance, financial transparency, prompt disclosure of important information, and elimination of internal corruption.

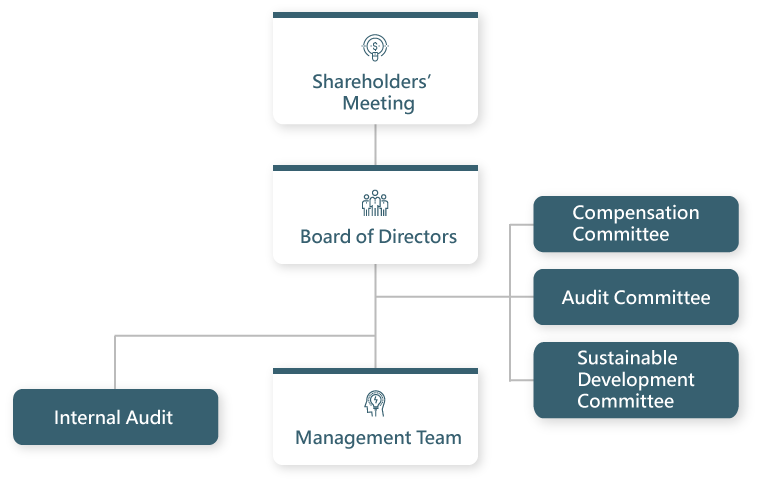

The Company convenes shareholders’ meeting every year and holds regular Director election in accordance with the “Director Election Procedures.” The tenure of the 10th Board spans from May 30, 2023 to May 29, 2026.

The Company has established the “Code of Practice for Corporate Governance” to ensure the Board's governance capability, and the diversity policy is stipulated in the “Strengthen the Board’s Functions” section. The policy requires Board members to possess eight key abilities, i.e., operational judgment, accounting and financial analysis, business management, crisis management, industrial knowledge, global market perspective, leadership and decision-making. The expertise of current Board members covers global perspectives, regional management capabilities, financial management, copper manufacturing, polymer chemical engineering and international business, which shapes a well-structured Board. Please refer to Appendix I ESG Information - Governance Information of this report for detailed information on Board members.

For corporate governance transparency, the Chairperson of Taiflex would not concurrently serve as the President in principle. If such a situation arises, it would only be a temporary arrangement for a transition period not exceeding six months. No such occurrences were recorded in 2023.

The three Independent Directors account for one-third of the total number of Directors in the Board, which is in compliance with the law. Upon assessment, all Directors have met the independence criteria. Circumstances set forth in Paragraphs 3 and 4, Article 26-3 of the Securities and Exchange Act do not exist, including situations where Directors are spouses or within seconddegree of kinship to each other.

The Company also assesses the independence of directors, including whether they can consistently raise constructive issues to the management and other directors, whether their views are independent of other directors or management, and whether their actions and behaviors inside and outside the Board are appropriate.

In accordance with the Company's “Rules of Procedure for the Board of Directors’ Meetings,”for agenda items of which the Director or the juridical person the Director represents has a personal interest, the Director shall disclose the major aspects of such personal interest at the current board meeting. If the interest may impair the interest of the Company, the Director shall not participate and shall recuse himself/herself from the discussion and voting of the agenda items. Such Director shall not exercise voting right on behalf of another Director. Directors and managers shall secure approvals from the shareholders’ meeting and the Board in accordance with applicable laws and regulations when they take actions that are within Taiflex's business scope for themselves or on behalf of others and shall fully disclose all transactions with related parties in accordance with the reporting requirements of relevant securities laws. We have verified that there were no incidents of insider trading or corruption involving Board members and senior management of the Company in 2023. Detailed information regarding the recusal of Board members due to conflict of interest can be found in our 2023 Annual Report.

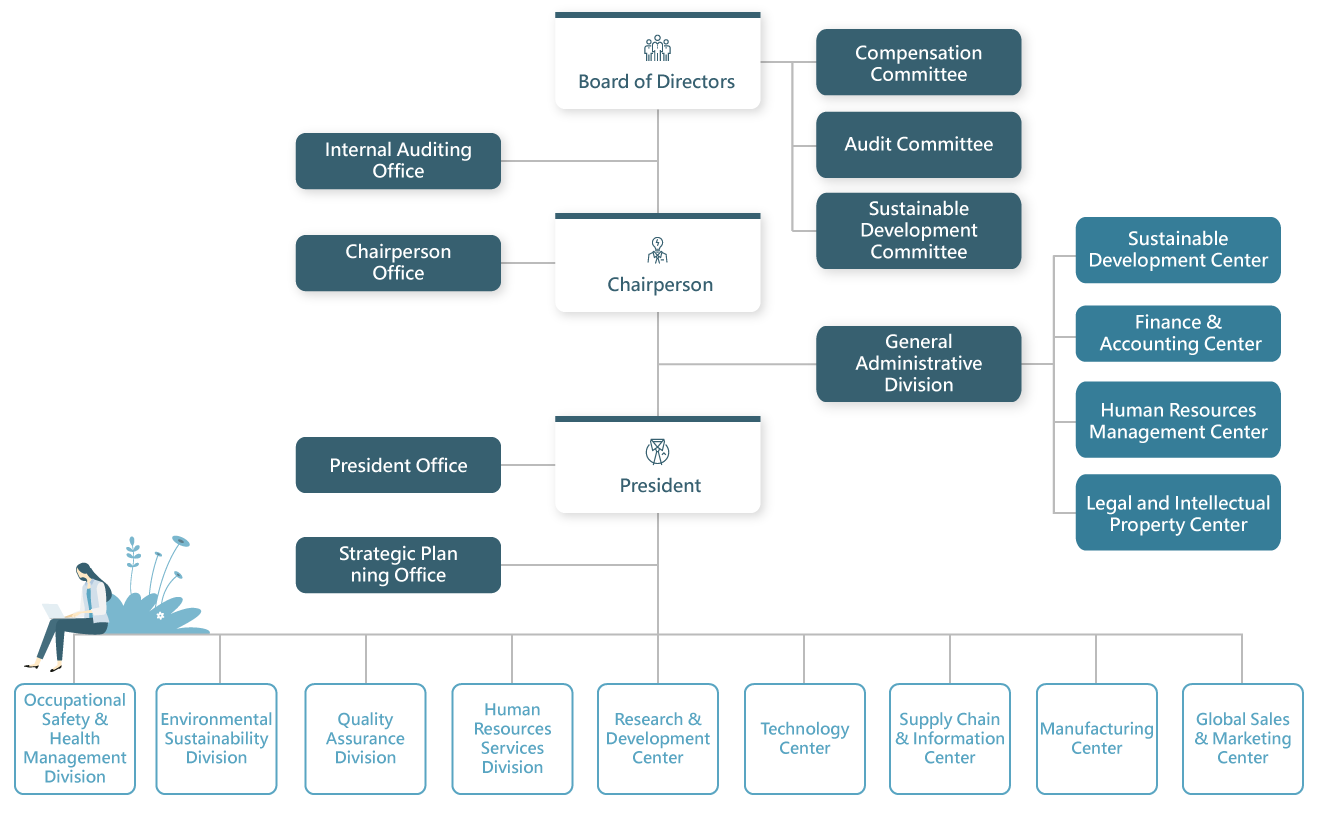

To effectively leverage the functions of the Board and to improve the quality of the Board decisions, the Company has established the Compensation Committee, the Audit Committee and the Sustainable Development Committee under the Board of Directors by duties and functions to address important corporate governance, economic, environmental and social issues. There is also the Internal Auditing Office, an administrative audit unit, which audits and evaluates the reliability and effectiveness of the Company's internal control system, and regularly reports audit findings and makes improvement recommendations to the Audit Committee to facilitate effective operations within the Company. For more information on the Sustainable Development Committee, please refer to “1.1 Sustainable Development Committee” of this report.

In 2017, the Company has established the Audit Committee in place of the Supervisors. By leveraging the professional competence and independence of the three Independent Directors, the Company has implemented corporate governance, improved the oversight function and strengthened the management mechanism. The Audit Committee held six meetings in 2023 where members had an attendance rate of 100%.

As for the Compensation Committee, it is composed of three Directors appointed by the Board, including at least two Independent Directors. Its main responsibility is to assess the overall compensation and benefits policies of the Company, as well as the compensation policies and systems of Directors and managers, in a professional and objective manner, and make recommendations to the Board as reference in making decisions. The Compensation Committee held six meetings in 2023 where members had an attendance rate of 100%. The Company's Articles of Incorporation stipulate that remuneration to Directors and Supervisors shall not exceed 4% of the annual profits. Please refer to our 2023 Annual Report for details on remuneration to Directors and managers.

The Board of Directors is responsible for the appointment, nomination and performance evaluation of senior management. It also delegates authority to senior management to handle economic, environmental and social issues arising from operations. To ensure an effective implementation of strategies, the Board not only receives regular reports from the management team, but also frequently communicates and discusses with the management, urging the management team to make appropriate adjustments. Good communications between the Board and management team are the cornerstone of Taiflex's sustainable operation.

The Board of Directors convenes regular quarterly meetings to review matters reported by functional committees and development strategies proposed by the management team. For all agenda items to be fully understood and discussed, relevant personnel are invited accordingly to attend and report at the Board meetings. The feasibility of each item is properly evaluated by the Board before it can be implemented. In 2023, a total of seven Board meetings (with an average attendance rate of 100%) were held to review 54 agenda items, including 51 items related to environmental, economic and social issues.

| Aspects of Agenda Item | Important Communication Results |

|---|---|

| Environmental Aspect | The 2023 sustainable development plan was approved, outlining goals and implementation plans for renewable energy, carbon reduction, and waste reduction. In addition, environmental-related capital expenditures of approximately NT$200 million were approved. A mid-year review of the overall implementation progress was conducted in 2023. |

| Economic Aspect | The Board reviewed the 2023 business plan and discussed recommendations from the external evaluation performed by Taiwan Corporate Governance Association during the Board meeting for subsequent improvements. Additionally, the risk map for the Company's operational risks was reviewed, along with response strategies. A report on information security was presented, and the positions of CISO and a dedicated Information Security Officer were established. |

| Social Aspect | The Board accepted shareholders’ proposals, reviewed employee bonuses, and formulated an employee stock option plan for profit-sharing. |

To continuously enhance the Board's professionalism and skills, the Company regularly schedules diverse training courses related to business operations and sustainable development for Directors. Through external education for Directors to understand global trends and diversify their perspectives, we aim to strengthen the Board's leadership and decisionmaking abilities for it to exercise due care of a good administrator when engaging in business operations, and ultimately maximizing shareholder returns and boosting the competitiveness of the Company in the face of the ever-changing business environment.

In 2023, the training hours of all Directors have met the statutory requirement (i.e., 6 hours), with a total of 54 hours of training and an average of 6 training hours. Please refer to Appendix I ESG Information - Governance Information of this report for detailed information on the continuing education of the Board members in 2023.

| Title | Name | Course | Duration | Total Hours |

|---|---|---|---|---|

| Chairperson | Ta-Wen Sun | 2023 Seminar on Prevention of Insider Trading | 3 | 6 |

| 2023 Taishin Net Zero Summit | 3 | |||

| Director | Ching-Yi Chang | Corporate Governance and Corporate Social Responsibility: Trends and Best Practices | 3 | 6 |

| Securities Illegality and Responsibility of Directors and Supervisors | 3 | |||

| Director | Chein-Ming Hsu | Legal Risks and Responses to Corporate Investment and Financing - From the Viewpoint of Directors’ Responsibilities | 3 | 6 |

| Risks and Opportunities of Climate Change on Business Operations | 3 | |||

| Director | Re-Zhang Lin | 2023 Seminar on Prevention of Insider Trading | 3 | 6 |

| Corporate Governance Seminar | 3 | |||

| Director | Fu-Le Lin | How Would the Board Formulates ESG Sustainable Governance Strategies | 3 | 6 |

| Corporate Growth Strategy and Open Innovation | 3 | |||

| Independent Director | Wen-I Lo | Protection of Trade Secret and Non-competition | 3 | 6 |

| Global and Taiwan Tax Reforms and Corporate Tax Governance under ESG Trends and Pandemic | 3 | |||

| Independent Director | Shi-Chern Yen | Promoting Sustainable Development through Risk Management - Risk Management Best Practice Principles for TWSE/TPEx Listed Companies | 3 | 6 |

| Commercial Litigation and Dispute Resolution in Practice | 3 | |||

| Independent Director | Yung-Shun Chuang | Corporate Governance Seminar | 3 | 6 |

| Directors and Supervisors Seminar - “Corporate Resilience and Competitiveness of Taiwan” | 3 | |||

| Director | Chun-Chi Lin | Global and Taiwan Tax Reforms and Corporate Tax Governance under ESG Trends and Pandemic | 3 | 6 |

| Legal Risks and Responses to Corporate Investment and Financing - From the Viewpoint of Directors’ Responsibilities | 3 |

To implement corporate governance, an internal Board performance evaluation shall be conducted at least once a year pursuant to the “Methods for Evaluating Board of Directors’ Performance.” At the end of each year, the Board agenda unit collects information on Board activities, distributes the “Self-Assessment Questionnaire for Board Members” and the “Self-Assessment Questionnaire for Functional Committees” to each Director and committee members, and reports the evaluation results at the next Board meeting. By clearly defining performance objectives, we aim to enhance the functionality of the Board and strengthen its operational efficiency. Details and recommendations of the 2023 performance evaluation were presented in the Board meeting in January 2024.

| Internal Performance Evaluation Results for 2023 | |||

|---|---|---|---|

| Type | Methods | Grading Criteria | Results |

| Performance evaluation on the Board | Evaluation by the Board agenda unit based on the actual operation of the Board |

|

The overall score was 92.21, equivalent to a rating of excellence. The result indicated a relatively sound operation of the Board, conforming to the spirit of corporate governance. |

| Performance evaluation on individual Board members | Self-assessment by Board members |

|

The overall average score was 98.48, equivalent to a rating of excellence. The result indicated that the Directors gave positive reviews on the operation efficiency and effectiveness of various evaluation items. |

| Performance evaluation on functional committees | Self-assessment by functional committee members |

|

The average scores of the Compensation Committee, the Audit Committee and the Sustainable Development Committee were 96.99, 96.88, and 95.92, respectively, equivalent to a rating of excellence. The result indicated that the functional committee members gave positive reviews on the operation efficiency and effectiveness of various evaluation items. |

The Company conducts a Board effectiveness evaluation (including performance) once every three years. In 2022, the Company commissioned the professional and independent Taiwan Corporate Governance Association to carry out the evaluation, which encompassed eight aspects of the Board (composition, guidance, authorization, supervision, communication, internal control and risk management, discipline and others), questionnaires with 10 open-ended questions, and online interviews with Board members and senior executives.

The Board performance evaluation report was issued on November 29, 2022, and we incorporated improvement suggestions from the evaluation as references for continuous enhancement of Board functions. On January 11, 2023, the improvement suggestions along with measures to be adopted were presented in the Board meeting. We plan to conduct another external Board effectiveness evaluation in 2025 to further improve our practices.