As the climate change issue deteriorates, stakeholders are highly concerned of corporate climate actions, including GHG inventory and reduction, and climate risk assessment and adaptation strategies. How to map out the capital expenditure and long-term strategies of a company amidst the complex variables has become an important issue affecting corporate competitiveness.

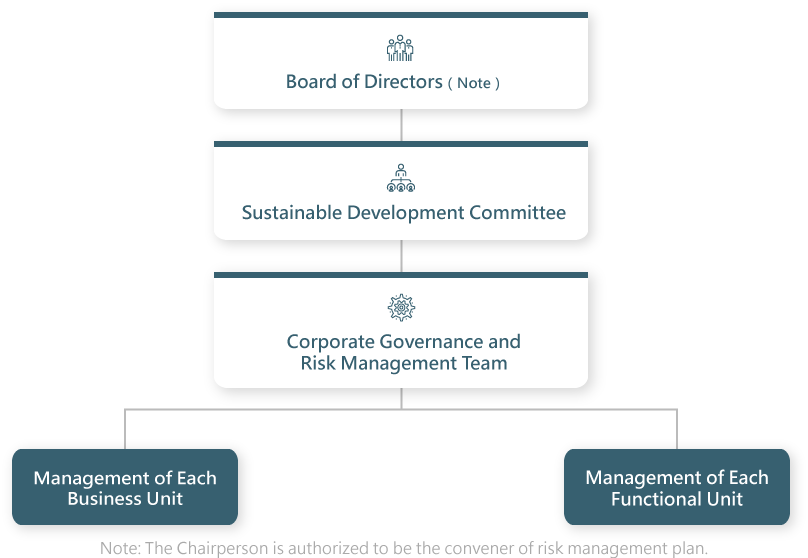

The Board of Directors serves as the highest decision-making body for risk management in the Company, overseeing the effective operation of risk management mechanism to ensure that the Company's business strategies can be effectively implemented to achieve business objectives. The Board authorizes the Chairperson to be the convener of risk management plans, coordinating and directing the plan promotion and operation.

The Corporate Governance and Risk Management Team under the Sustainable Development Committee consolidates risk elements identified at each level of the organizational management system, risk response strategies and implementation reviews, and reports to the Sustainable Development Committee on the execution of risk management. The Sustainable Development Committee then reports to the Board at least once a year on the performance of the overall risk management plan.

The Company has established the “Risk Management Policies and Procedures” to enhance its risk management awareness and execution capability. Through the establishment of a systematic management method, we incorporate relevant response plans as a basis for formulating business strategies. This approach ensures that risks stay within a tolerable level, minimizing potential losses to safeguard the interests of customer s, employees, and other stakeholders, thus increasing shareholder value and achieving optimal allocation of corporate resources.

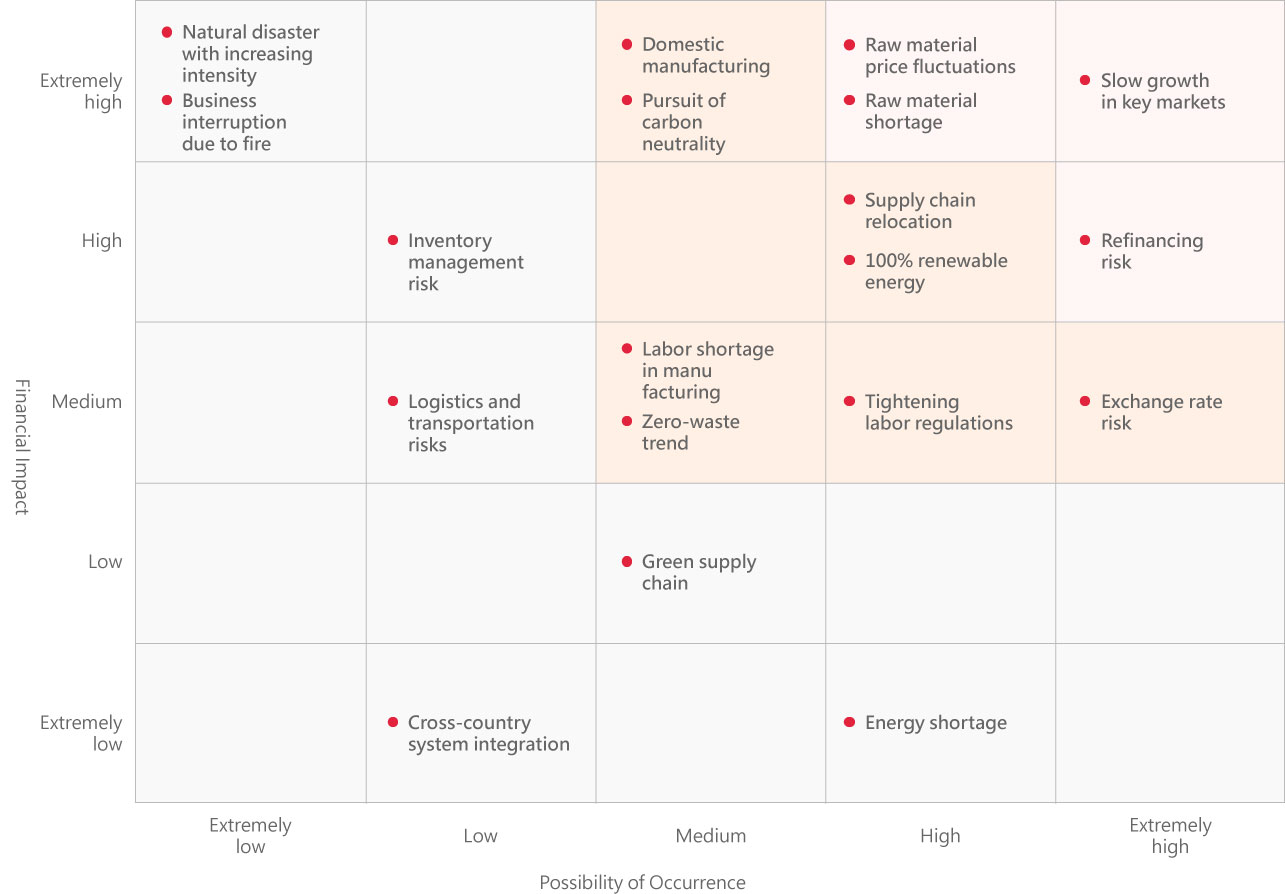

The Company stays up to date on internal and external issues as well as environmental changes. In addition to factors such as the Company's scale, industry, business characteristics, operational activities, and sustainability (including climate change), we also place importance on environmental, social, and corporate governance issues concerned by stakeholders. In 2023, management of each functional unit identified the following 18 major risks that could impact the achievement of strategic objectives:

| Scope of Risk Management | Major Risk Items | Risk Items Identified in 2023 |

|---|---|---|

| Strategic Risks |

|

|

| Operational Risks |

|

|

| Financial Risks |

|

|

| Information Risks |

|

|

| Compliance Risks |

|

|

| Integrity Risks |

|

-- |

| Hazardous Risks |

|

|

| Climate Change Risks |

|

|

The aforementioned risks were used to create a risk map based on their impact and probability of occurrence, so as to prioritize the risks and develop relevant response plans. Major risks identified in 2022 were: “slow growth in key markets,” “raw material price fluctuations and shortage,” and “refinancing risk,” which were reported to the Board along with response plans in 2023. The action plans and mitigation measures concerning climate risk are available in the Company's annual report.

After evaluating the impact and probability of risks identified, relevant units are assigned to carry out risk response plans. For risk map items with high probability of occurrence and significant impact, corporate resource would be consolidated to establish a task force, and continuously review and modify the execution status of each risk to mitigate their impact.

As countries around the world strengthen their carbon reduction targets and policies, aiming for net zero emission by 2050, the pressure on business operation and customers’ demand for supply chain sustainability have intensified. Although Taiflex is not subject to the major electricity consumer clause, we have mapped out relevant investments to reduce carbon emissions in response to the low carbon transition driven by global climate changes. We will continue to focus on and implement climate action targets following the Paris Agreement as well as the targets of stakeholders, and gradually incorporate them into our sustainable development strategy.

The Board had approved the sustainable development roadmap in January 2023 and authorized the Sustainable Development Committee to manage climate risks. Functional teams under the Committee are tasked with promoting climate action issues and goal management. This ensures the integration of sustainability strategies and climate action issues into product, operation, and value chain management.

The organization's governance of climate-re lated risks and opportunities

The actual and pote ntial impact of climate-re lated risks and opportunities on the organiza tion's business, strategy and financial planning

The organization's process for identifying, assessing and managing climate-related risks

Metrics and targets for assessing and manag ing climate-related risks and opportunities

The Sustainable Development Committee reports to the Board twice a year, reviewing climate change-related risks and opportunities, and proposing corresponding short, medium, and long-term plans, measures, and goals. The Board regularly evaluates the effectiveness of climate response strategies based on the plan progress of functional teams summarized by the Sustainable Development Committee (Sustainability Center).

Conduct cross-departmental discussions to address short, medium, and long-term climate risks and opportunities identified; adopt scenario analysis to assess potential financial impacts on the Company; integrate resources to determine the allocation priority, and formulate response strategies based on the Company's technological advantages. Currently, we focus on the following two directions:

With reference to the risk identification/assessment model recommended by TCFD, climate risk items are incorporated into the existing risk management process, with response plans and objectives proposed for each item. The Sustainable Development Committee tracks and manages these plans and objectives on an ongoing basis and regularly reports to the Board on the implementation status in order to refine the overall strategic direction.

Both the Corporate Governance and Risk Management Team and the Environmental Sustainability Team under the Sustainable Development Committee work together on analyzing climate-related risks and opportunities based on the TCFD framework. The Committee then consolidates the information and formulates the following promotion plans, which have been reviewed by the Board.

| Risk Category | Transition risk | Transition risk | Physical risk | Physical risk |

|---|---|---|---|---|

| Aspects | Policy and regulation | Market | Immediate | Long-term |

| Stakeholder | Taiflex | Taiflex, customer | Taiflex, supply chain | Taiflex, supply chain |

| Climate Risk | Cap-and-trade, carbon fee and carbon tax | Net zero emission trend, environmental protection erformance | Extreme weather disasters | Rising temperature |

| Potential Financial Effect |

|

|

|

|

| Climate Opportunity |

|

|

|

|

| Potential Financial Effect |

|

|

|

|

| Management Approach |

|

|

|

|